Each one of us has a limited lifespan. The way society is currently organised is such that we spend the earlier parts of our life growing up and learning the skills required to survive. We then exchange our time and skill set for money which can be used to pay for our daily needs and stored for our future needs.

Hence, one's assets consist of human capital – our time and skill set which can be exchanged for money throughout our lifetime, and financial capital – made up of savings and anything of value that we own which can also be used to generate income.

Growing your financial capital

Human capital can be estimated by discounting all future income one can be expected to earn to today's value. Since $1 to be earned in 30 years' time will have a lower purchasing power compared to $1 today due to inflation, discounting adjusts all future earnings to today's value at the expected rate of inflation.

All else being equal, a younger person's human capital is higher than that of an older person's because a younger person has a higher number of expected working years ahead.

After many years of training, a doctor's human capital is significantly higher than the average person's because of his/her higher earning power. Nevertheless, like everyone else, a doctor's human capital will decline over time due to age.

Thus, it is important for all of us to replace our human capital with financial capital as we age, through savings and investing,1 so that we can continue to earn an income even when we have stopped working. This is important given our increasing life expectancy.

Figure 1. As you age, your financial assets should replace your human capital

Figure 1. As you age, your financial assets should replace your human capital

Assumptions:

- Annual income starts at $60,000 a year, growing at 12% a year until age 62;

- Expenses start at $30,000 a year, growing at 10% a year until age 39, after which expenses grow at 3% a year; and

Real investment return at 6% a year, discount rate at 3% a year.

Figure 1 shows our declining human capital and how, through savings and investing, we can rebuild ourselves as a financial asset.

However, you can see two drastically different outcomes in terms of the value of financial assets depicted by the orange and red bars, despite both having the same income and savings rate over the 37-year period.

The difference is that orange was able to grow his/her savings at a real return of 6% year. Real return means actual growth in the purchasing power of the money after accounting for inflation. If inflation was 3%, your money has to grow at 9% to achieve a real return of 6%.

Red, however, decided to hold on to his/her cash over the years. The cash loses purchasing power because of inflation. Assuming an inflation rate of 3% a year, the financial assets of this ultra-conservative doctor at age 62 is valued only at $1.6 million. Meanwhile, the doctor who is more financially savvy and has been growing his/her money at a real return of 6% a year is now sitting on a pile of assets valued at $15.8 million.

The art of investing

Where should we invest our money in order to generate a real return of 6% a year over the long term then?

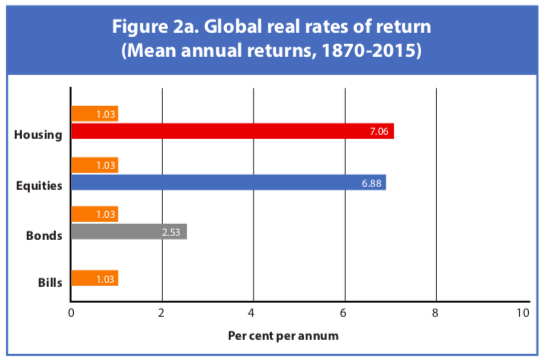

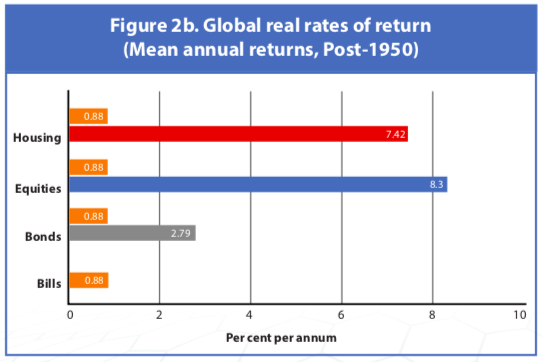

In a paper titled The Rate of Return on Everything, 1870-2015 published last year, the authors collated data of asset prices and returns from 16 advanced countries from 1870 to 2015. Their findings are plotted in Figure 2.

The authors included housing as an asset class and rental income as part of the asset's return. Before World War II, housing outperformed equities. But after World War II, equities have outperformed housing on average.

Compared with equities, an investment property that yields rental income requires huge initial outlay which may be out of reach for some. Real estate is also more susceptible to adverse policy risks, idiosyncratic risks pertaining to that particular property, and concentration risks. That leaves us with equities as the more accessible option to growing our financial assets. Not only do equities provide a positive real return (ie, beating inflation in the long run), they also provide a nice premium over other traditional asset classes, such as fixed income. Diversification can also be easily achieved and transaction costs are generally low.

The only catch is, as the authors pointed out, equities have much higher volatility and higher synchronicity with the business cycle.

This leads us to our next questions: What are the risks of investing in a portfolio of equities for future income? What does higher volatility and synchronicity with the business cycle mean for an average investor and an investor who is a doctor?

Volatility causes the value of equities to go up and down significantly over a short period of time. High synchronicity with the business cycle means that equities prices tend to fall when times are bad – when businesses are more likely to fail and when employees are more likely to lose their jobs. If you are someone whose income is tied to the general economic environment, then you can count on the equities market to add to your misery when times are bad. It is precisely this reason – that your financial assets will decline when you most likely need to tap on them – that equities reward investors with a premium above the returns of other asset classes. As one investment writer noted, "No pain, no premium".

Doctors, however, are in a privileged position. Not only do you command a higher salary, you are also less likely to be retrenched because demand for medical services is unrelated to the performance of the larger economy and its bewildering cycles of expansion and contraction that bedevil the rest of us.

This means that you are unlikely to have to tap into your financial assets while you are working. As such, you can afford to take a longer-term approach to building up your financial assets by allocating a larger portion of your savings than the average person to equities. Accept the volatility in the short term, for it is the currency that investors need to pay, in order to earn excess returns in the long run.

Instinctively, some doctors know this. The result is that "Doctors can go from one dodgy idea to the next without ever alighting on a sensible approach that puts them in the way of making money," noted Phil DeMuth in his book, The Affluent Investor.

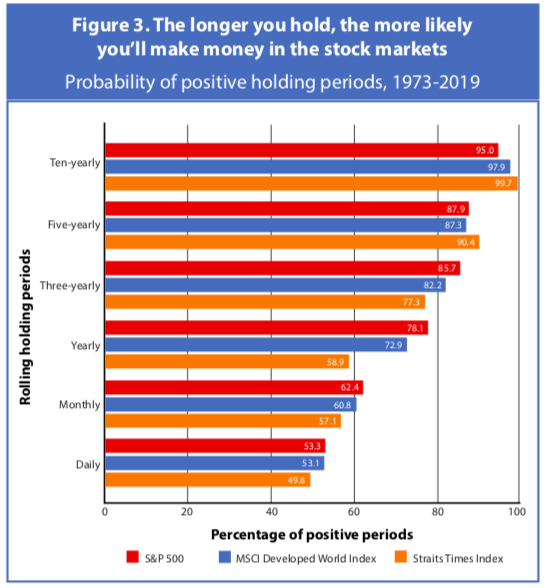

The proven path to making money in the long term is through equities. As shown above, equities can generate more than 6% real return over the very long term. But in the short term, it can fall by 30% or more within a year. When these episodes happen, the media will have screaming headlines such as "Blood-letting across global markets!" or "Trillions wiped out as markets plunge". No doubt, these episodes cause a lot of anguish as they are happening.

However, if you hold a diversified portfolio of fundamentally sound companies, then the long history of stock markets tells us that these losses are only temporary.

Figure 3 shows the percentage of positive returns for rolling one-day to ten-year holding periods, using daily data. For a holding period of one day, the odds of positive returns are no better than a coin toss. The odds get better the longer the holding period. For a holding period of ten years, the probability of positive returns is nearly 100%!

Real risks of investing in equities

Given the volatility of equities, their readily available prices and ease of transaction, there are bound to be risks. For us, the real risks of investing in equities are as discussed below.

Overpaying

A stock price should reflect the price of the business/company, which in turn should be – like the human capital we talked about earlier – a discounted value of all its future earnings. But unlike human capital, a business can have perpetual life. In addition, its earning capacity can vary depending on its innovation, what its competitors do, and the evolving landscape of its industry, among other things. Given its perpetual life and the high variability of its earning capacity, the value of the company or business can fluctuate quite drastically. This is exacerbated by investors who, when afflicted by over-exuberance or panic, continue to chase after well-performing stocks or dump poor-performing ones.

Hence, one of the biggest risks of equities investing is to pay significantly higher than what a stock is worth. For example, a business that is in fact worth only $100 million, or say $1 per share but, because of a very rosy narrative that surrounds it, has a share price that is bid up to $10 a share, giving it a valuation of ten times more or $1 billion. When the euphoria dies down and reality hits, and the company is not able to meet the market's very high expectations of it, its share price will plunge. Investors who bought the shares at $10 will suffer very long-term loss in capital.

Over-concentration

Related to overpaying, the fate of the investor will be made worse if he/she puts all or most of their savings in one or two over-valued stocks. If we are able to spread our investments into a number of stocks – given a certain degree of unpredictability of the future – we will end up overpaying for some stocks while picking up some bargains as well. Hopefully, using a very disciplined approach to picking undervalued stocks based on known valuation metrics, we will end up with more bargains than over-valued stocks. Consequently, the portfolio as a whole will be able to grow in tandem with, if not better than, the markets.

Behavioural risk

The returns of most fund investors fall short of the market, due to behavioural errors like performance chasing, believing that they can time the market or giving up on investment plans at the first sign of volatility in the markets. As mentioned, if you have a diversified portfolio of companies that are fundamentally sound and fairly valued, or better still undervalued, then any decline in the value of your portfolio is likely to be temporary. But if you panic and cash out, then you are making your loss permanent and depriving your portfolio of the chance of recovery.

Saving for retirement

Final question: In saving for our retirement, what numbers should we be concerned about?

Naturally, you will need more financial assets if you choose to retire earlier, given that you will have no employment income for a longer duration. This means that you will have to save more aggressively and grow your savings at a faster rate to achieve your targeted level of financial assets.

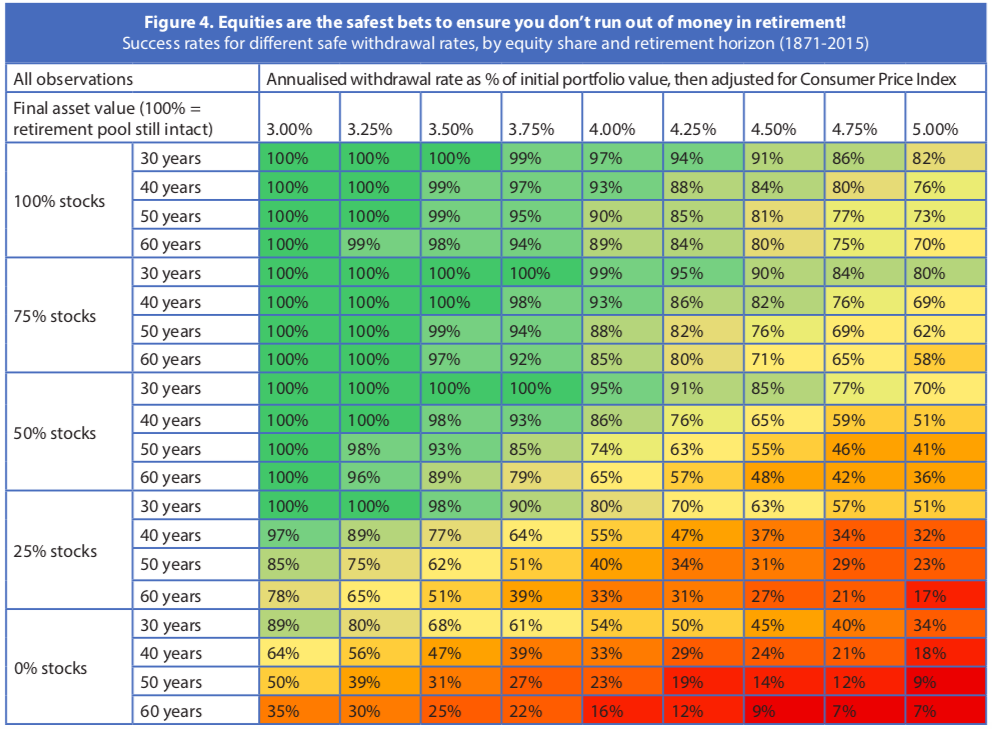

Depending on how much you need to spend on a yearly basis in retirement, you can work backwards to arrive at your targeted level of financial assets. Our study of the Singapore market suggests that you can safely do a 5% withdrawal from your financial assets provided you put 100% of those assets in equities, specifically the Straits Times Index.1

So if you need $50,000 to live on a year in retirement, then at a 5% withdrawal rate, you will need financial assets of $1,000,000 fully invested in equities. If you need $100,000, then you need to aim for $2,000,0000. My study assumes a fixed withdrawal amount a year.

The blog Early Retirement Now did a simulation of various withdrawal rates as a percentage of the initial financial assets, and the amount is adjusted for inflation in subsequent years. They also varied the length of retirement years and allocation to equities and bonds. The returns of US equities and government bonds from January 1871 till December 2015 were used for the study. The study results are reflected in Figure 4.

In conclusion, generally, a withdrawal rate of 4% is often used as a rule of thumb, but the precise safe withdrawal rate is affected by many variables like return of assets, inflation and longevity.

All else equal, the success rate increases as (1) withdrawal rate decreases, (2) retirement horizon decreases, and (3) percentage allocated to equities increases.

There you have it – a blueprint to saving for your retirement.

A quick recap

- We all need to save and invest to supplement and eventually replace our depleting human capital.

- The proven way to grow our savings and financial assets over the long term is through equities as they have, over the long term, yielded returns significantly above inflation rate.

- The only catch is that equities are volatile in the short term and tend to decline in value when the general economy is bad.

- Given that doctors' livelihood is not so correlated with the macroeconomy, you can afford to take a long-term view.

- The long history of stock markets shows us that risk of loss from a diversified portfolio of equities is zero or almost zero for holding periods of ten years or more.

- As to how much you need to save, it depends on how much you need to live on post-retirement. As a general rule of thumb, you need to build up your financial assets such that you don't need to tap it for more than 4% a year. The higher amount you allocate to equities, the higher the chances that your financial assets will not get depleted.